These claims have seen a five-day increase between FNOL and vehicle release in recent years, resulting in carriers spending hundreds of additional dollars per claim.

Auto Total Losses Are Challenging

Navigating a total loss claim is difficult for everyone. Consumers become aggravated with process uncertainty, disjointed communication and managing multiple vendors. As the process drags on, carriers face increasing costs through storage fees, rental charges and productivity loss.

With a steady increase in auto total loss claims year-over-year since 2016, reimagining collaboration across the insurance ecosystem is critical for reducing cycle times, lowering costs and improving the customer experience.

Current Total Loss Experiences

For Carriers

- Claim rep frustration trying to reach customers while managing repetitive information from multiple systems

- Longer cycle times with high-touch claims

- High costs from process delays

For Policyholders

- Process uncertainty at every step

(Questions like, “What do I need to do to get paid?”) - Fragmented communication with various vendors and repetitive conversations

- Phone tag, voicemails and emails causing daily disruptions and long wait times

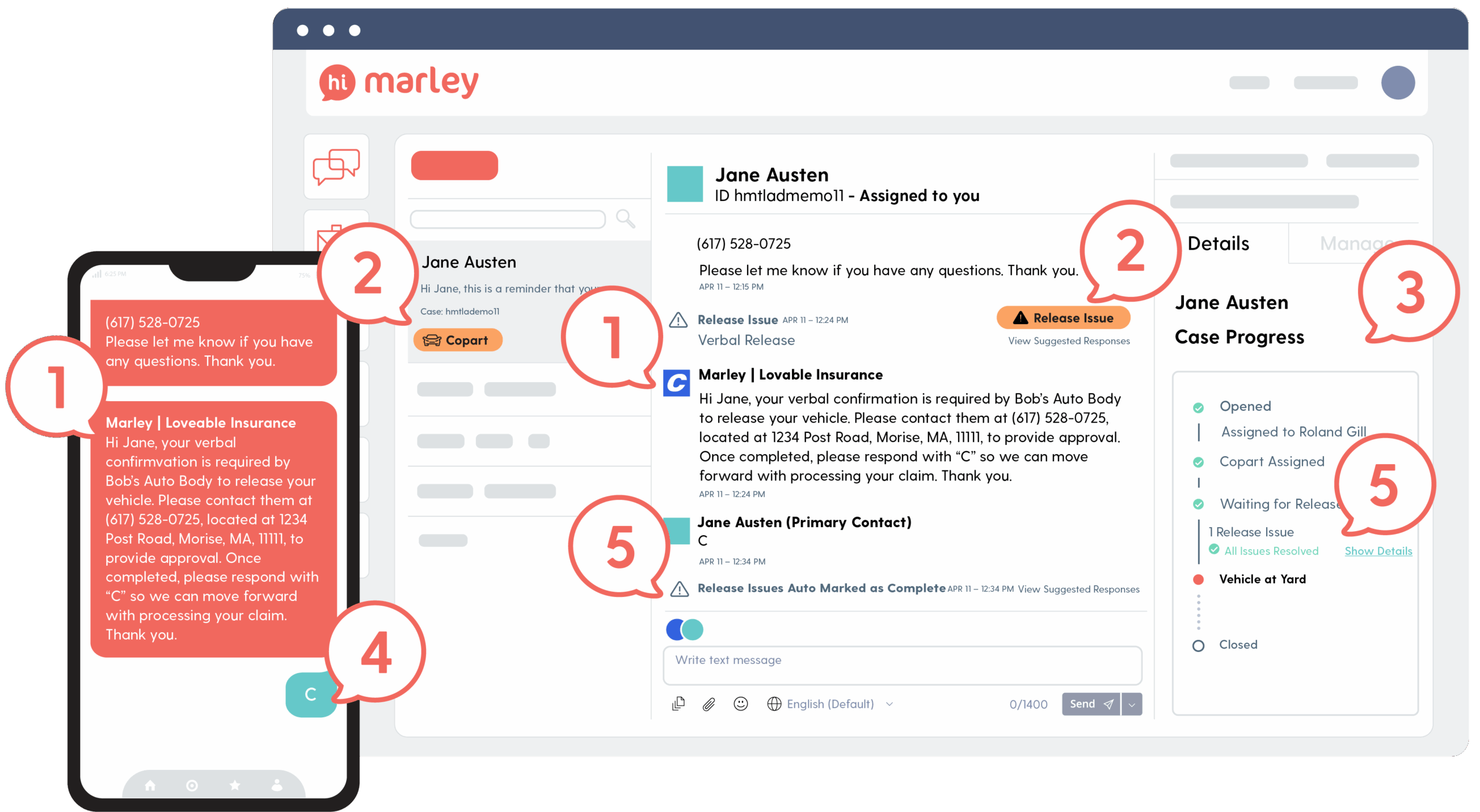

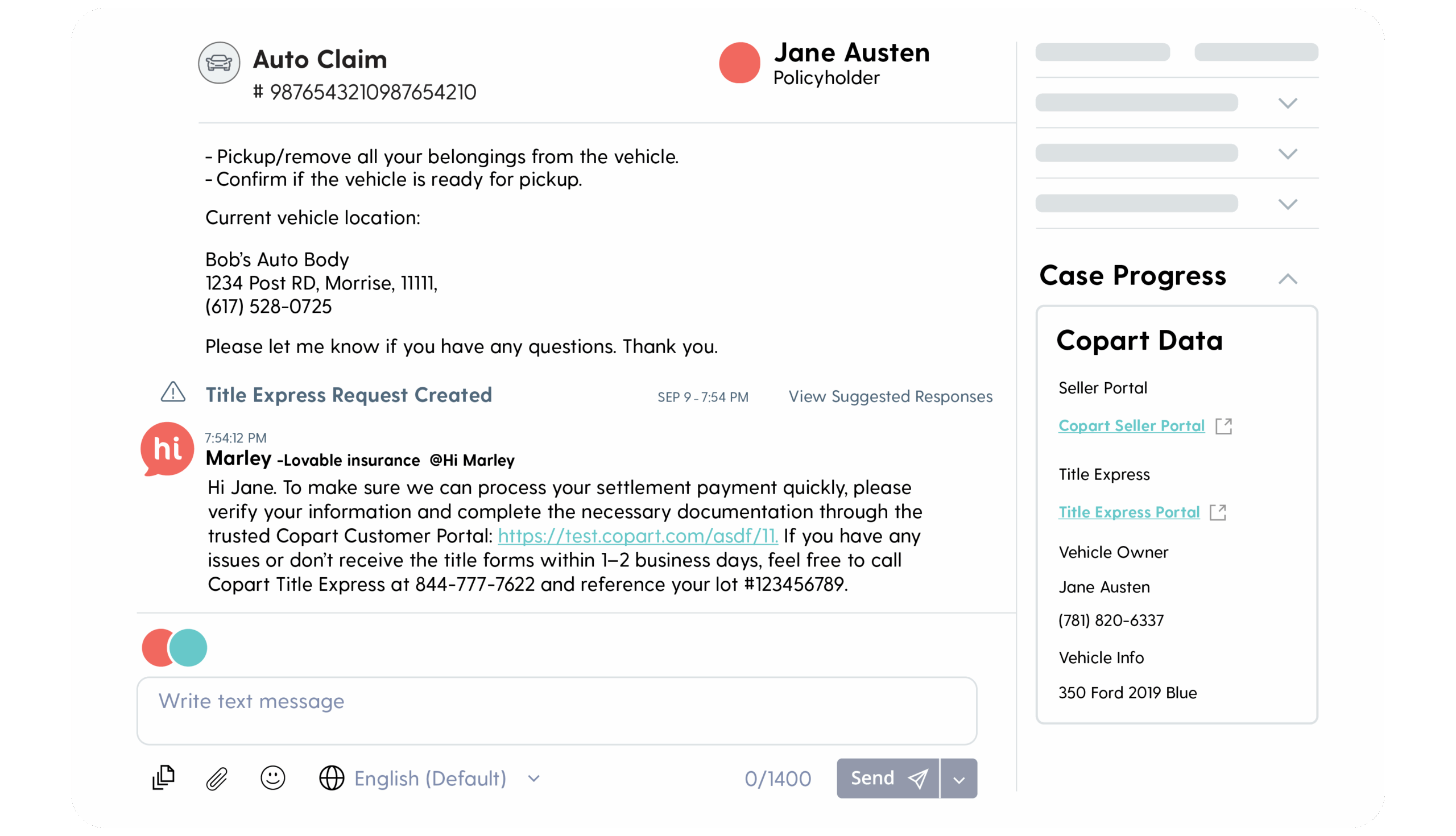

Hi Marley’s Total Loss Assist™

With Hi Marley’s Total Loss Assist, carriers can tackle total loss process inefficiencies to improve claims handling. Through our seamless integration with the Copart Seller Portal, Hi Marley reduces the number of touchpoints needed to resolve auto total loss claims while increasing customer satisfaction.

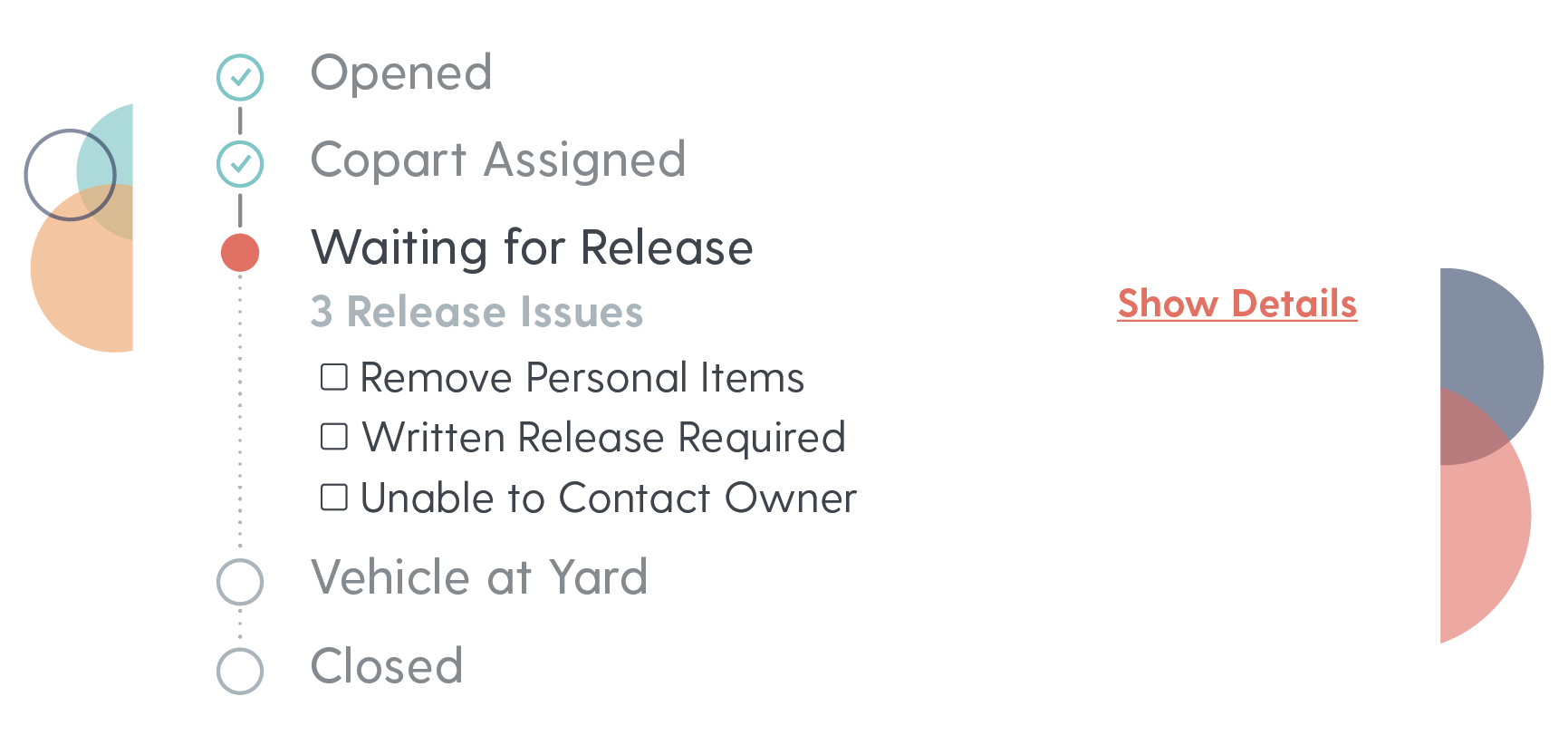

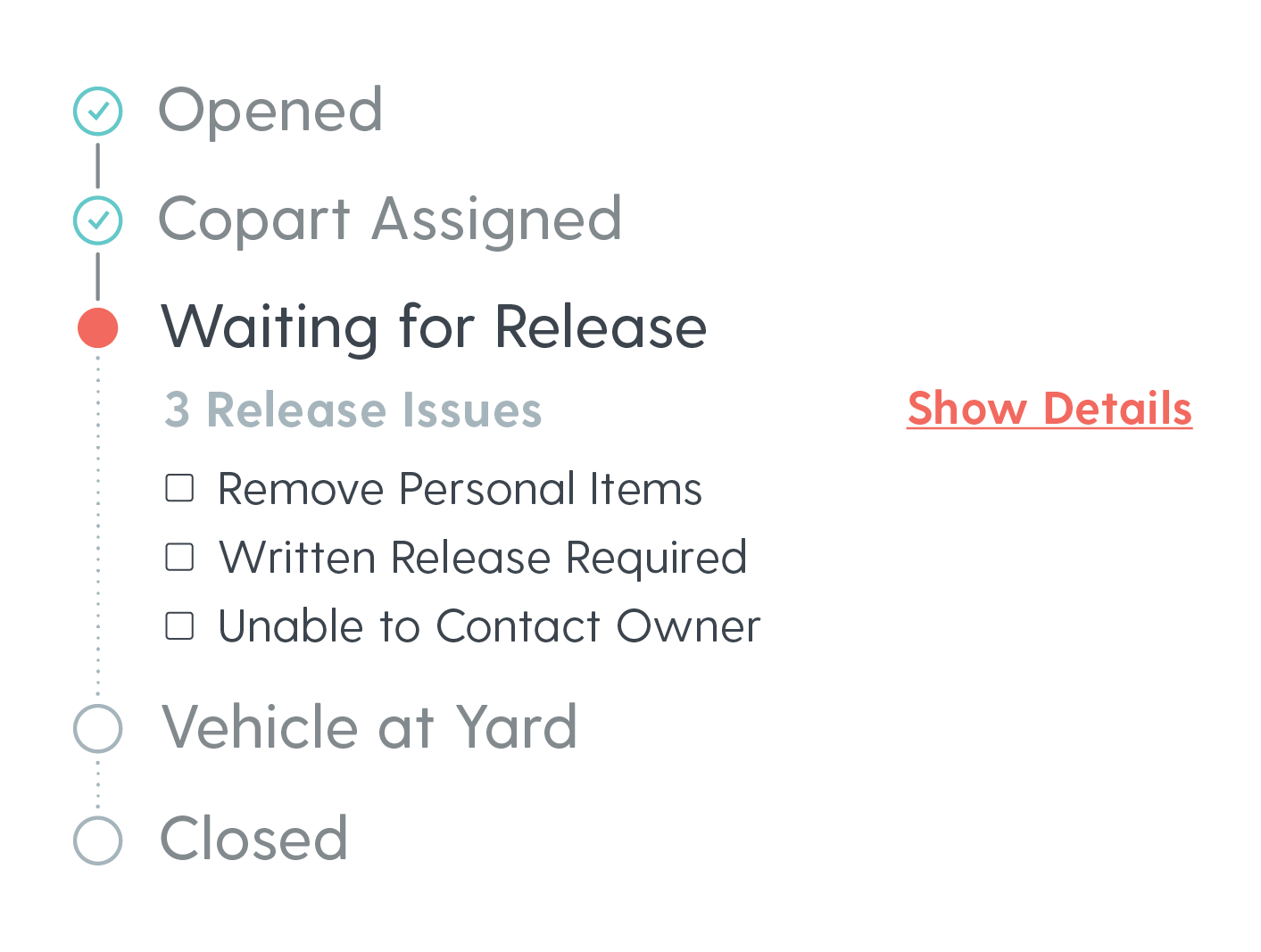

Workflow Assist

As an auto total loss claim is processed, Hi Marley tracks claim progress alongside the ongoing text conversation to:

- Identify claim status

- Keep users informed about what’s next

- Highlight release or other process issues

- Provide details on active steps

- Enhance supervisor support