Voice of the Policyholder Survey: Insights from Florida Homeowners Highlights How Carriers Can Improve Claims Following Hurricanes

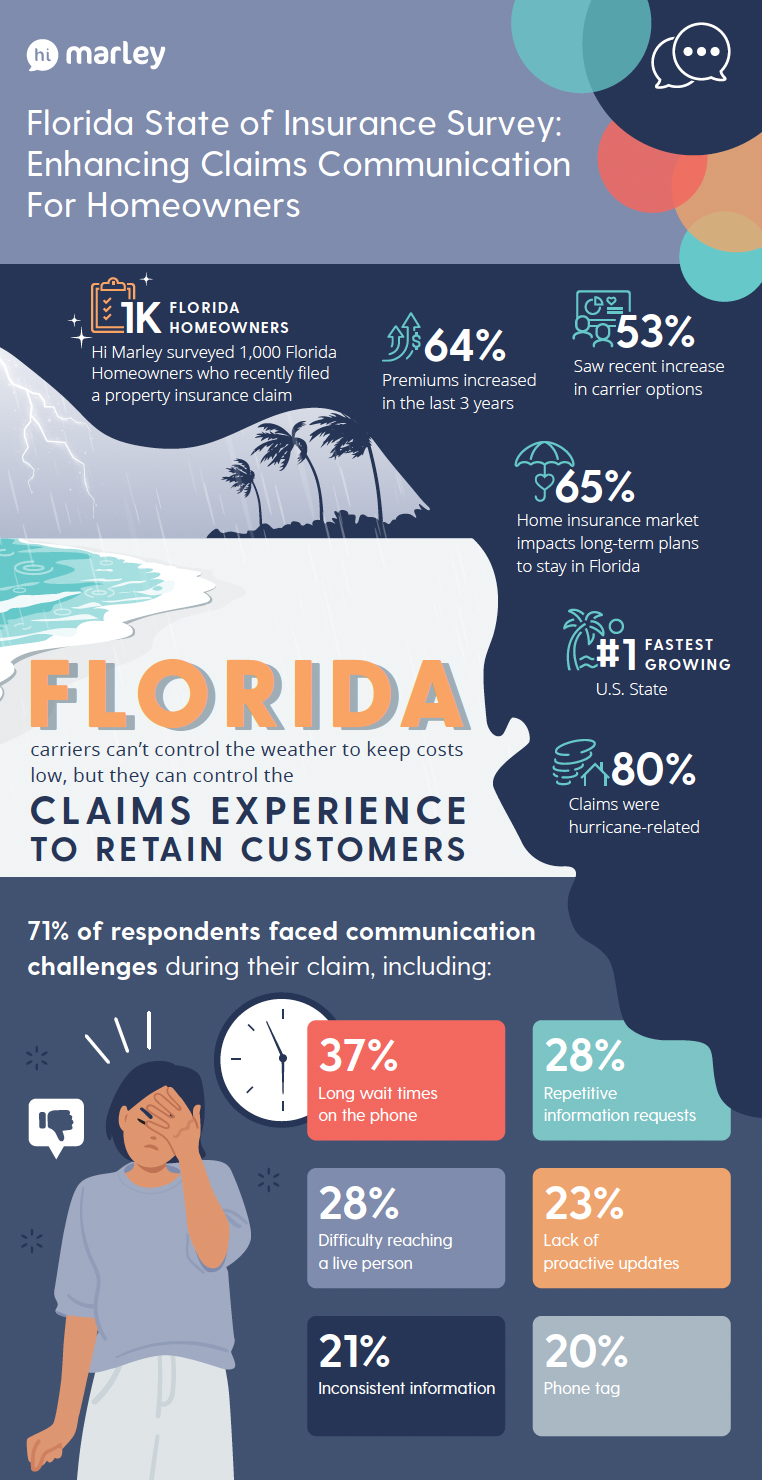

In Hi Marley’s Florida State of Insurance Survey, a survey of 1,000 Florida homeowners who filed an insurance property claim in the past three years, nearly 80 percent were hurricane-related, underscoring the region’s exposure to catastrophic events and potential challenges for insurers.

As a result of increased storm frequency and severity, coupled with rising construction materials and labor costs, home insurance premiums are getting more expensive. In fact, 64 percent of survey respondents said their premiums increased in the last three years. This trend is especially concerning, as J.D. Power’s recent study found that insurer-initiated rate rises—the highest in over a decade—erode trust among policyholders and increase the likelihood of customer attrition.

Fifty-three percent of those surveyed said there are more carriers to choose from in the Florida homeowners’ market in the past three years. With more policyholders shopping around, staying competitive is more important than ever. Carriers can’t control the weather to keep costs low, but they can take steps and offer solutions to enhance the claims experience and retain customers.

Florida Homeowners Face Communication Challenges When Filing Claims

Even with recent legislative reforms and carriers’ proactive efforts to offer more competitive options, 71 percent of claimants still said they faced communication challenges during the claims experience, including:

- Long wait times on the phone (37 percent)

- Repetitive information requests (28 percent)

- Difficulty reaching a live person (28 percent)

- Lack of proactive updates (23 percent)

- Inconsistent information from different representatives (21 percent)

Hurricanes often lead to a surge in claims. To keep up, adjusters need tools that can efficiently handle high claim volumes. Fifty-five percent of respondents said their insurance carriers offered a mobile app, 48 percent said their insurance carriers had a dedicated online claims portal, and 42 percent said their insurance carriers provided texting capabilities.

Hi Marley’s survey found that text messaging, in particular, offers significant advantages during the claims experience.

Text Messaging Reduces Phone Tag and Makes Getting in Touch with Adjusters Easier

When carriers offered texting, 51 percent of respondents said their claim was resolved faster than expected. Satisfaction was also significantly higher: 81 percent were satisfied or very satisfied with their carrier’s customer service (compared to 67 percent when texting wasn’t offered), and 51 percent were very satisfied with carrier communication throughout the claim (compared to only 40 percent when texting was not an option).

Trevor McDonald, CPCU, AIC, Vice President of Claims at American Integrity Insurance Company, one of the largest and most trusted residential property insurers in Florida, said, “Customers today expect fast, convenient communication. With Hi Marley, we deliver on that expectation through seamless, two-way texting that improves connection, speeds resolution, and builds trust.”

Providing a texting option following hurricanes also ensures that customers can reach their insurance company anytime, anywhere, and receive timely support, further improving the customer experience.

Additionally, more than a quarter of survey respondents are multilingual, speaking English alongside another language. With Hi Marley’s translation feature, all parties can communicate in their preferred language, with text messages automatically translated in real time, allowing adjusters to keep the conversation going, improve responsiveness and resolve the claim faster.

Outreach Allows Carriers to Mitigate Loss Exposure with Proactive Notifications and Timely Updates

With Hi Marley, carriers can also mitigate loss exposure by sending proactive text notifications to policyholders with tips and checklists to prepare for catastrophic events before they occur, along with real-time updates during and after.

For example, the Plymouth Rock team uses Hi Marley Outreach™, the platform’s mass notification capability, to send proactive notifications to policyholders in a storm’s path before hurricanes, helping them mitigate losses. The carrier follows up again after the storms with a message to impacted policyholders outlining steps to take, including instructions and links to report their claims.

“We approached the aftermath of the storm, looking at what we could control and broke it up into manageable phases,” said Doug Sprous, Vice President of Claims at Plymouth Rock Assurance. “The ability to communicate effectively, efficiently and not have redundancy was key. We just looked at every opportunity to use Hi Marley to get in front of the customer with valuable information—it was a helpful tool for us.”

Conversational FNOL™ Eliminates Long Wait Times and Repetitive Information Requests by Creating a Consistent, End-to-End Conversation

The influx of calls that follow hurricanes can make it challenging to handle several customers at once, often creating wait times and long call queues to file claims. Text messaging helps adjusters document and triage claims earlier, allowing them to serve more people in a timely manner, which is crucial following a CAT event.

With Hi Marley’s Conversational FNOL, policyholders can file a claim quickly and explain what happened in their own words. They then answer any follow-up questions and share photos and videos of the damage via text. Responsible AI then converts the media and customer story details into structured, actionable claim data without lengthy calls, hold times or restrictive forms.

“Hi Marley allows us to offer our customers a texting option; something they’ve requested for a long time,” said Melissa Dos Santos, Director, Claims at Florida-based Heritage Insurance Company. “And our claim examiners quickly saw the benefits of texting with policyholders. Once the customer submits an FNOL, adjusters can jump right into an existing conversation and schedule the first contact, saving significant time.

They also love that they now have the option to use text to send a quick message, answer questions, confirm information and follow up faster and easier than before.”

Creating an end-to-end conversation, Conversational FNOL allows anyone handling the claim throughout the process to jump in and quickly see the status, context and details of the claim, ensuring that policyholders receive consistent, up-to-date information.

To further streamline property claims, carriers can leverage Hi Marley’s Workflow Assist™, the integration with Verisk™’s industry-leading XactAnalysis® platform to automate key updates and keep policyholders and adjusters up-to-date throughout the process.

Hi Marley Can Help Florida Carriers Remain Compliant with Strict Communication and Regulatory Requirements

Beyond improving customer communication, Hi Marley also helps carriers stay compliant with Florida’s stricter communication requirements by automatically uploading transcripts to the claim file and keeping all interactions with the policyholder in a single conversation thread.

“Hi Marley is the only vendor that offers insurance-specific security and compliance features that meet all of our requirements,” said Trevor McDonald. “With Hi Marley, American Integrity can capture, define and save all conversations with insureds directly to the claim file, saving time and reducing the administrative burden on our adjusters.”

Carriers can also add other parties from the insurance ecosystem to the Hi Marley conversation, enabling seamless collaboration and eliminating phone tag and communication breakdowns.

These capabilities give adjusters additional capacity when it’s needed most, accelerating claim cycle time, elevating customer service and improving outcomes following catastrophic events.

Check out the Florida State of Insurance Survey: Enhancing Claims Communication For Homeowners infographic to learn more, or visit www.himarley.com/property to discover how Hi Marley makes property claims easier, faster and more transparent.