Reactive, Real-Time and Proactive Insights Drive Lovable Experiences

Our recent study on what drives 1-star and 5-star customer satisfaction scores found that adjuster attitude and approach is the top driver of five-star claims experiences. Adjusters often deal with customers on their worst days—a house fire, a hurricane, a car accident—and it’s their job to provide support and assistance during a crucial time of need.

Hearing our customers talk about the challenges they experience as adjusters and supervisors, I have so much empathy for the stress and burden that they carry. As a product team, our job is to understand our customers’ pain points, problems, workflows, and day-to-day activities and then think through how our technology can alleviate some of those pain points and ensure our product features are valuable and make an impact.

Hi Marley’s mission is to make insurance simple and lovable for both carriers and policyholders. We look for ways to amplify the voice of the customer while supporting adjusters and supervisors by giving them the tools that make their jobs easier. One way we’re doing this is through our new Coaching Capabilities that empower employees with AI-driven alerts and tailored performance insights.

I joined Hi Marley in January, coming in mid-flight on this project. The product team had been thinking about Coaching and laying the foundation for the past two years. They were incredibly thoughtful in their approach. Instead of rushing to get these capabilities to market as fast as possible, they were intentional with creating something scalable. They built a completely flexible engine, so now we can accelerate and expand these coaching capabilities in the future. I’m proud of how we all came together to deliver these features, as well as some surprises and delights beyond what we initially planned, and we’re not done yet! Coaching has come a long way and will continue to evolve.

Reactive: How Do We Learn from Past Experiences?

In February 2021, Hi Marley launched our first Looker Insights dashboard that gave administrators access to new data that allowed them to understand their organization’s performance and learn from past events to inform all future experiences.

We continue to build out our analytics layer with additional dashboards because if carriers stop looking at and learning from the past, they will miss crucial changes they can apply to the future. We started with the admin dashboard, then added a supervisor dashboard. We also have individual dashboards where adjusters can click from a personalized landing page to see the most important cases. We’re trying to hit every persona to ensure everyone in the organization speaks the same language from a metrics perspective and is empowered with data to learn from and inform the future.

Real-Time: How Do We Impact Conversations as They Happen?

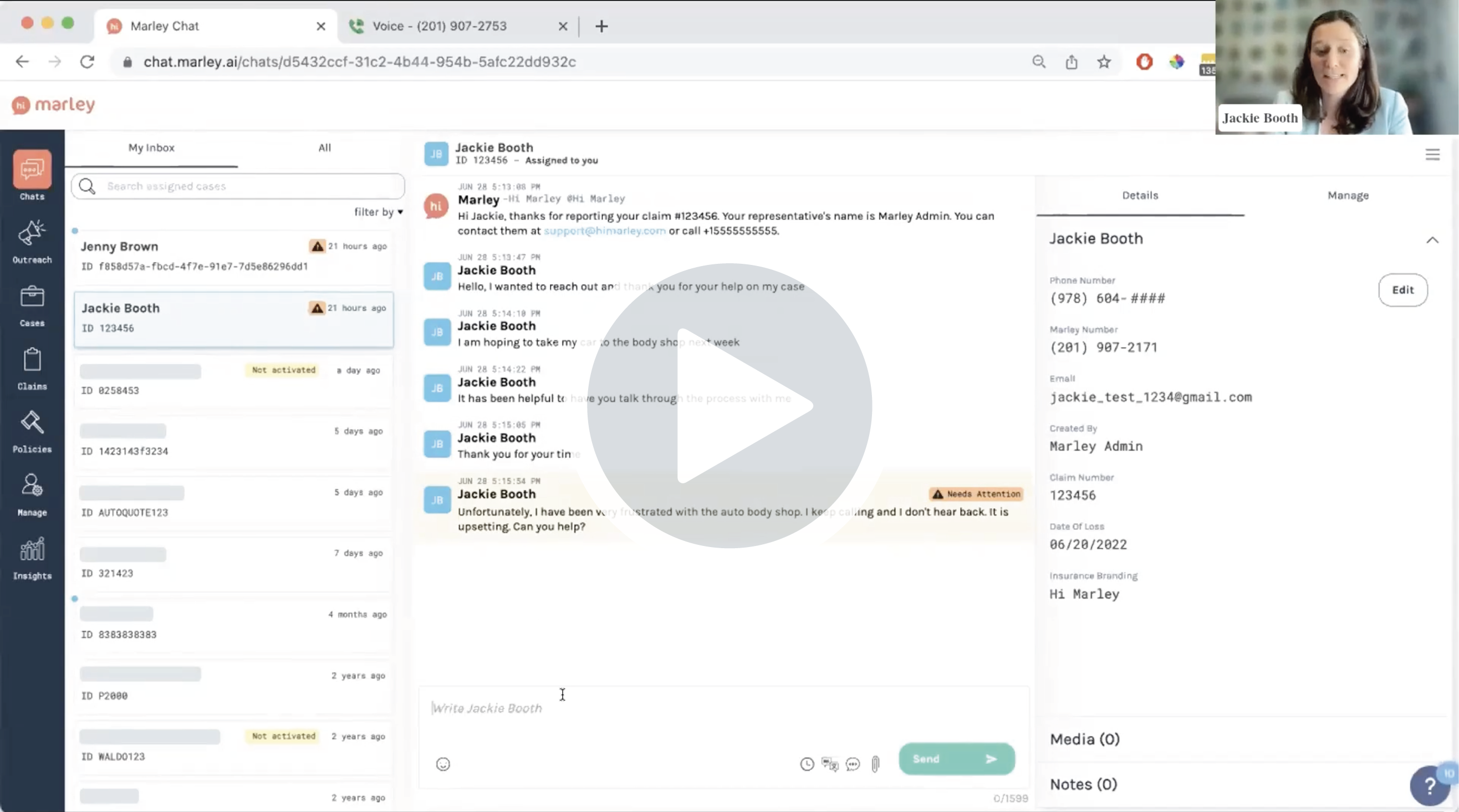

A year later, we went into alpha with our first real-time analytics capability, with a goal to impact conversations as they happen. For example, a negative sentiment notification could alert an adjuster to a conversation where a customer seems frustrated. This amplifies the voice of the customer and helps the operator prioritize what actions they should take next.

We received amazing feedback on the negative sentiment alpha. With negative sentiment alerts, adjuster response time improved by 20 percent for messages with negative sentiment, and the capability has also helped bring attention to breakdowns in the claim process across the network of players involved.

One customer said, “[Sentiment notifications] have been extremely helpful with bringing attention to breakdowns, specifically with auto body shops not responding, or parts not getting in because of the supply chain issues. We can quickly jump in to triage what we’re seeing, set expectations and make a service recovery.” Amplifying the voice of the customer and escalating that frustration enables the adjuster to provide an empathetic response, reach out to the body shop, or reset expectations.

In addition to sentiment, we have added alerts for litigation risk and delays and will continue investing in real-time enhancements.

Proactive: How Do We Influence the Arc of Conversations in the Future?

As we think about our roadmap, the next layer we are working toward is proactive. Some might say, “aren’t real-time sentiment notifications proactive?” I would argue that if someone is already angry, you didn’t proactively prevent that frustration.

The goal is to influence the arc of conversations and hit the person with the right message at the right time to avoid conflict escalation and cut down on cycle times. It is all about proactively getting ahead of messaging and planning the next communication touchpoint to ensure the customer feels heard, safe, secure and provided for throughout the claims process.

Coaching is about productivity and ease; those two factors go hand-in-hand to impact cost savings and resolution times and ultimately help more people. In terms of our product evolution, all three layers are necessary for Coaching because, while proactive alerts can reduce escalations, once conflict occurs, we want to ensure adjusters can intervene in real-time and resolve the issue quickly. Our goal is to make adjusters’ lives easier by amplifying the voice of the customer and transforming negative experiences into lovable ones.

Learn more about how on-the-job Coaching and insights can help your organization accelerate efficiency and improve performance.

Webinar: How to Reduce Customer Churn & Improve Employee Performance with Coaching

Jackie Booth delivers a first-hand demo and joins insurance vets Mark Snyder and The Auto Club's Lori Pon to discuss how AI-enabled Coaching capabilities are empowering employees to impact customer and employee satisfaction and drive better retention and loyalty.