Three Ways Hi Marley Coaching Capabilities Can Help Retain Employees

A recent study found that insurance is one of the most stressful industries to work in. The turnover rate for insurance employees is high, especially for adjusters, with 83 percent of adjusters leaving their role within three years and auto adjusters staying at their job for one to two years on average.

Carriers are experiencing unprecedented employee turnover rates. Unfilled positions cause stress to employees who have to take on additional work, and just one vacant position can cost a company almost $5,000 per month. Insurance providers need tools that help employees manage their workloads, increase efficiency, strengthen their skills and drive satisfaction to attract and retain talent in today’s competitive market.

“In working with Hi Marley, we’ve seen how a communications platform can change a customer’s experience in a moment of need,” said Teresa King, Senior Vice President and Chief Claims Officer at Encova. “And it also changes the experience for our claims team. These are professionals dedicated to helping our customers – and giving them better tools matters.”

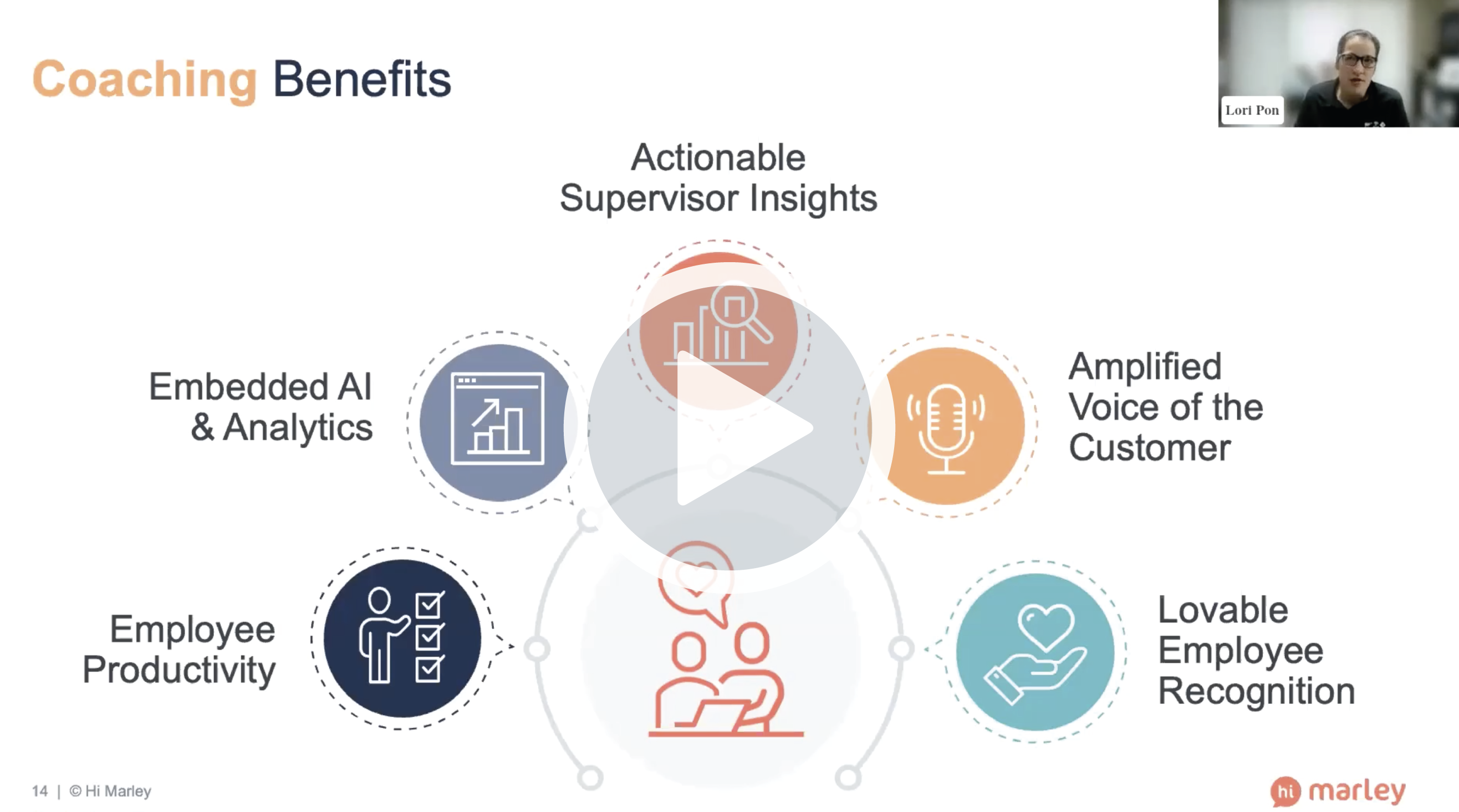

Hi Marley’s AI-enabled collaboration platform facilitates hassle-free texting across the entire ecosystem. Texting not only streamlines communications, but text messages also provide valuable insight into the policyholder experience and employee approach and performance. Hi Marley recently announced Coaching capabilities, leveraging the data captured in texting conversations to offer carriers actionable insights and on-the-job development for their teams. Here are three ways insurers can use Coaching to attract and retain top talent.

1. Coaching Ensures Employees Build Professional Skills and Continue to Learn

More than half of the insurance workforce will retire by 2028; carriers are losing headcount and decades of institutional knowledge. Furthermore, 53 percent of P&C insurers report feeling understaffed and plan to aggressively hire in the next year—with operations and claims roles identified as areas most likely to add entry-level positions.

As newer, less-experienced insurance professionals join the workforce, carriers need to find ways to train new hires, offer resources that enable them to do their jobs and provide opportunities to grow professionally. However, according to Boston Consulting Group’s (BCG), “Insurance industry employees spend a few weeks or more on training per year, slightly less time than the cross-industry average,” BCG writes in the Decoding Global Talent series. “Possibly because employers don’t provide enough time during the workweek for employees to learn new skills.”

Through AI-driven alerts and actionable insights, Coaching can fill this training gap and help insurance employees excel in their roles. Hi Marley’s My Insights dashboard provides a personalized landing page with calls to action that help employees understand which steps to prioritize. And, embedded real-time “needs attention” alerts within conversational workflows identify at-risk conversations that need intervention and ensure employees are focused on the proper tasks to improve response times and drive customer satisfaction.

2. Coaching Gives Employees Flexibility in Where They Work

To attract and keep top talent, carriers must build a company that supports flexibility and trust, offering employees the opportunity to work where they want. BCG’s recent study found that 69 percent of insurance employees prefer a hybrid model of work that combines onsite and remote; writing, “A workforce in which a significant portion of people work virtually requires leaders to have different skills than in the past. Chief among them is the ability to support direct reports regardless of where they work.”

Hi Marley’s Coaching capabilities help supervisors support their teams remotely. For leaders, the My Org Insights dashboard captures organization-level data and allows users to drill into key cases and conversations to drive better outcomes throughout the business. Managing teams across multiple locations is easier with the My Team Insights dashboard featuring team performance metrics, including contact times, case health trends and caseloads. Managers can use this information to identify areas for improvement while implementing best practices. The dashboard also helps supervisors understand conversational sentiment through specific texting interactions, allowing them to offer support, provide additional training or intervene to de-escalate situations.

3. Coaching Helps Employees Feel Appreciated

Evolving employee expectations, a job seekers’ labor market and ongoing re-shuffling have made retaining key talent incredibly challenging. Now, more than ever, carriers must ensure their employees feel valued at work.

According to LinkedIn’s Inside the Mind of Today’s Candidate, being recognized for accomplishments is the top reason employees feel like they belong at their company. BCG also found that between 2018 and 2021, when asked about priorities insurance professionals look for in an employer, “appreciation for your work” increased in importance; with employees valuing appreciation even more than job security and career development opportunities today.

The My Insights dashboard helps employees see how they contribute to the organization and the tangible steps they can take to make a significant, meaningful impact. The dashboard features quotes of the day spotlighting positive customer messages to exemplify the lovable experiences they made possible. The positive customer quotes are visible to all operators, supervisors and administrators, so they can recognize and celebrate their team member’s success and continue to build a culture of appreciation.

Learn more about how on-the-job Coaching and insights can help your organization accelerate efficiency and improve performance.