Analysis Reveals What Differentiates

1-Star and 5-Star Claims Experiences

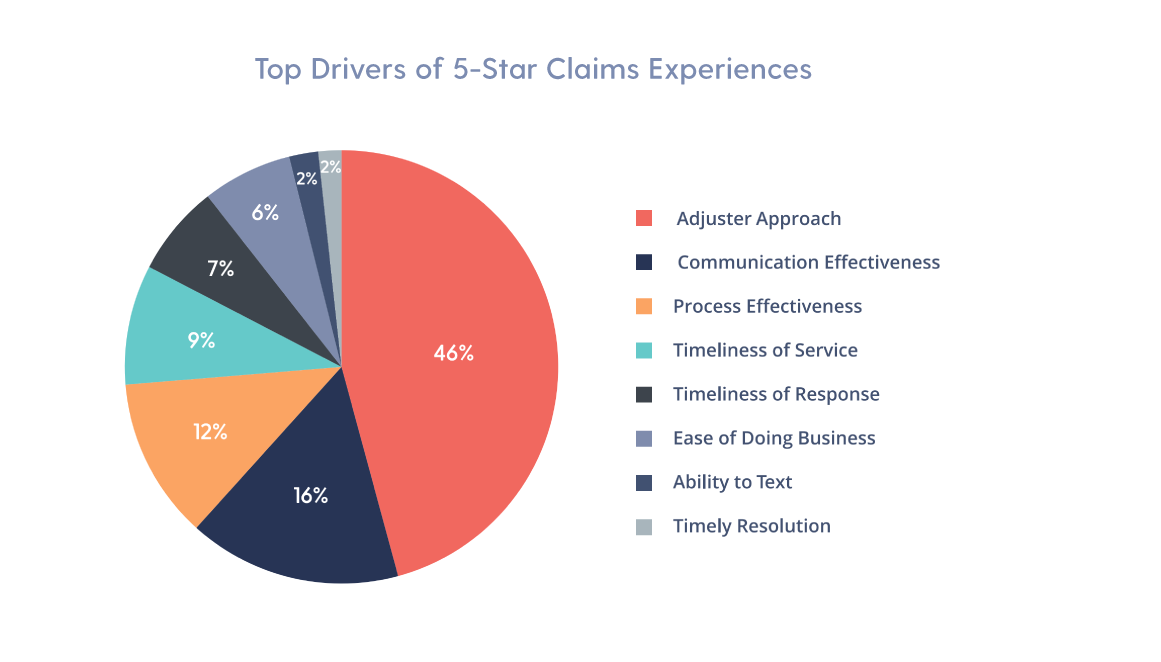

To better understand what drives claims consumer satisfaction, we analyzed nearly 25,000 1-and-5-star customer survey responses from more than 50 of our P&C carrier partners in Hi Marley’s database to reveal the biggest drivers of optimal and sub-optimal claims experiences.

This report explores key findings and the potential impact on carriers and claims customers, including:

- The four primary drivers of high or low satisfaction scores

- What differentiates a 1-star vs. a 5-star claims experience

- Examples of carriers driving 5-star claims experiences

- How carriers can improve their approach to customer service

- Outlook on the future of claims and customer experiences

- Additional industry trends and research

Related Content

With policyholder churn ranging from 10-16%, raising the bar in customer service and exceeding expectations are must-haves.

Carrier and CX Insights: Why Customer Satisfaction Matters

Customer Acquisition Costs 9x More than Retention

Improving customers' satisfaction remains a top priority for insurance carriers.

41% of Policyholders Switch Carriers After One Claim

That number jumps to 83% if they are dissatisfied with the experience.

Carriers Spend Up to $900 for Each New Customer

A positive claims experience can turn a policyholder into a customer for life.