Our Story: Hi Marley’s First Customers

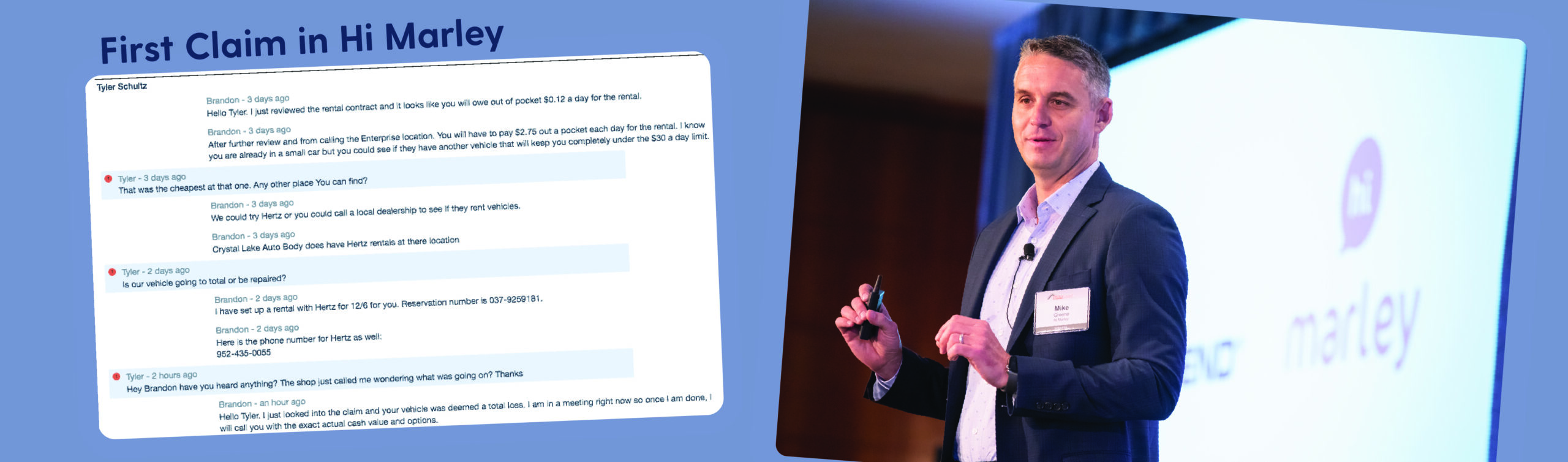

On December 7, 2017, Mike Greene, John Miller and Mitesh Suchak went to West Bend’s headquarters in Wisconsin to kick off the first pilot. The product featured a portal—that doesn’t look anything like the platform looks today—with a chat window where an adjuster could log in, enter someone’s phone number and send and receive texts. The customer could send pictures as well.

The trio sat in a board room with three claim reps. One rep said, “I have three new claims that came in, and I already asked them if they want to text, and they all said yes. So, when can we start texting?” And it began. They set up the first claim, sent a text, and got the customer’s response right away.

They stayed in the conference room for four days and watched all the claims come through, taking notes and monitoring the conversations. West Bend claims professionals learned the tool quickly, and supervisors had a level of transparency that never existed before.

The pilot demonstrated the value of text messaging; users immediately experienced how it could move claims along for customers. Adjusters commented on how much time they saved by not listening to voicemails and playing phone tag. And claimants made comments like, “I am a teacher, I can’t talk on the phone during the day, so texting is so much easier to get my questions answered.” The co-founders knew their idea had real market value.

Hi Marley’s survey module allowed customers to rate their experience at the close of the claim. The first five-star experience went to one of the adjusters who helped resolve a claim in an hour. Customers and reps loved text messaging. Word got out, and more adjusters wanted to try Hi Marley.

“We were aiming for 50 five-star reviews, and we did it. West Bend received an incredible number of five-star reviews during the pilot,” said Mike Greene. “Being in the room together energized us; witnessing it all happen was so cool.”

“The first pilot at West Bend is a high point in my entire career,” said John Miller. “For four days, we watched three adjusters handle claims, which may sound boring, but it wasn’t; watching it on the software you just created was surreal.”

He continued, “The concept we honed in on and got right was asynchronous communication and enabling adjusters—when we landed in West Bend and saw the impact of text messaging, it confirmed that we were on the right path. In the end, as we walked out the door to the airport, adjusters were holding up #WeLoveMarley and #NoMorePhoneTag signs. It was awesome.”

“Insurance is a risk-averse industry, but we’re lucky Dave Ertmer and West Bend took a chance on us and were willing to take risks. We’re forever grateful,” said Mike Greene.

Hi Marley Adds a Commercial Carrier, Successfully Sends Video File

Hi Marley secured a commercial carrier as the next customer. In the first use case of receiving video via text messaging, someone stole a laptop from a policyholder who owned a small business. With Hi Marley, the owner texted the claim rep a surveillance video that showed someone breaking in and stealing the laptop and a picture of the invoice for the computer. A claim that would typically take weeks to settle was resolved within one day because of the Hi Marley platform and streamlined communications using text messaging.

“Although I went to school to become an actuary, I didn’t care too much for P&C in the beginning,” said John Miller. “Some of the stories we’ve seen over the years are touching. In the early days, when we had a much lower volume, I would read through claims and start realizing these little things affect people’s lives in a very meaningful way. It has really sunk in how important this work is, and my appreciation for insurance has grown.”

Read more about Our Story.